In the constantly changing scene of renewable energy investments, the Vikram Solar IPO GMP has caught the interest of investors and market watchers. As India moves toward a more eco-friendly path, firms such as Vikram Solar take leading roles, making their public offerings very appealing. The Vikram Solar IPO GMP or Grey Market Premium gives an early hint about how the stock could behave once it gets listed. As the IPO is about to open, it is important to know what the Vikram Solar IPO GMP is for savvy prospective investors looking to capitalize on the opportunity.

Let’s read this blog in detail to get an idea about the Vikram Solar IPO GMP, company background, market trend analysis, and advice to the interested investors. No matter you are an experienced trader or a newbie in this field of stock market investment, both of you will require this guide to drill down into Vikram Solar IPO GMP excitement.

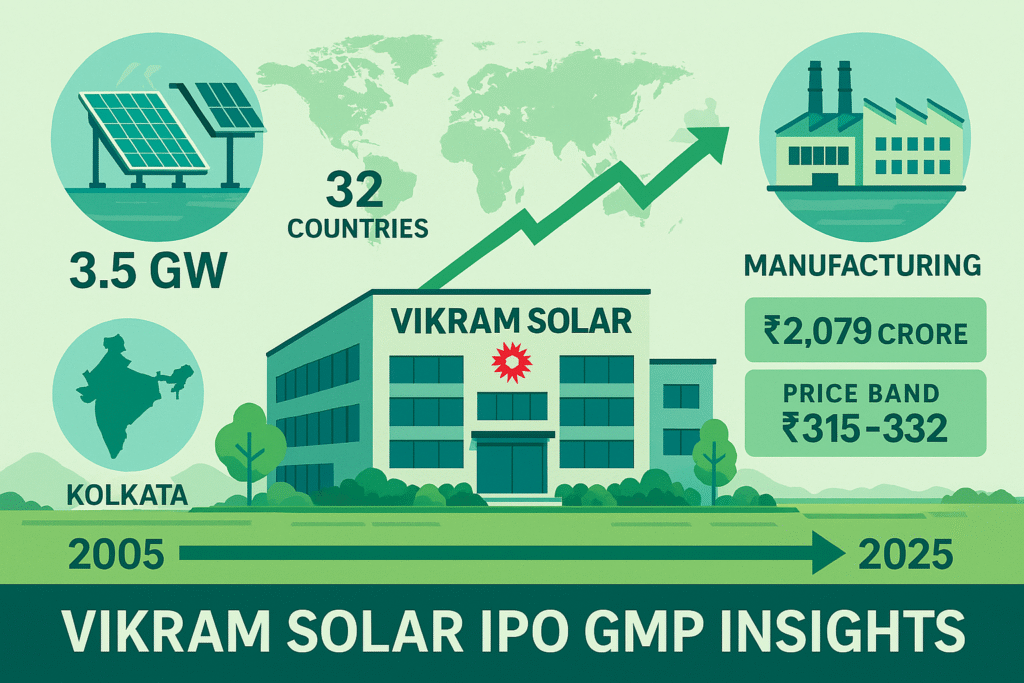

Vikram Solar Limited is India’s top-tier manufacturers of solar photovoltaic (PV) modules. It commenced its operations in 2005,having its head office at Kolkata. Over the years, the company has expanded significantly and currently possesses a running capacity of 3.50 GW as on March 31, 2024. This places Vikram Solar amongst the leading domestic participants within the solar PV industry.Their produts have applictions ranging from residential rooftops to large-scale utility projects that will play into India’s ambitious renewable energy targets.

Turn to the Vikram Solar IPO GMP—this is a major event in itself. The IPO that has been engineered by Vikram Solar to raise funds through fresh issues and OFS (Offer for Sale) has a composition of a fresh issue worth ₹1,500 crore and an OFS up to ₹579.37 crore. That brings the total issue size approximately at ₹2,079.37 crore. The price band for the Vikram Solar IPO has been fixed between ₹315 and ₹332 per equity share having a face value of ₹10 each. Retail investors have to bid for a minimum of 45 shares that aggregate not less than ₹14,940 at the upper price band.

The subscription window opens on August 19, 2025, and closes on August 21, 2025. The allotment is likely by August 23 with listing on BSE and NSE probably on August 26, 2025. This has led to increased interest in the Vikram Solar IPO GMP as investors try to get a feel of the pre-listing sentiment. Book-running lead managers who ensure a smooth process here comprise JM Financial, Kotak Mahindra Capital, and ICICI Securities.

This is why the Vikram Solar IPO GMP gets so important here. The Grey Market Premium is an indicative of the unofficial trading activity before the official listing, showing the kind of enthusiasm or caution among investors. A strong Vikram Solar IPO GMP augurs well for possible listing gains while a weak one connotes some risks.

The Grey Market Premium is the difference between the IPO issue price and at what rate shares are being traded in the unofficial or unregulated grey market. Though not any official metric, it is a rather strong indicator of market sentiments. In the case of Vikram Solar IPO GMP, it will indicate whether the stock shall be listed at a premium or discount.

By August 18, 2025, the Vikram Solar IPO GMP floats around ₹60 to ₹70 per share, which falls approximately 18% to 20% premium over the upper price band of ₹332. Just a while ago on August 13, it was reported at ₹70 thereby reflecting steady interest in the offer and its upbeat mood. Other sources have placed it at ₹63.50 or even as high as ₹66. An increase, indeed a rather consistent upward trend in the Vikram Solar IPO GMP.

Some of the factors that have contributed to driving the Vikram Solar IPO GMP include the booming solar energy sector in India facilitated by government initiatives such as the PM Surya Ghar Muft Bijli Yojana among other policies targeting to achieve 500 GW non-fossil fuel capacity by 2030. Other confidence boosters are Vikram Solar’s strong market standing, exports to more than 32 countries, and its diversified product portfolio. In addition, optimistic financials can be seen for this company due to revenue increases from ₹2,023 crores in FY22 to ₹2,285 crores in FY24 which has been accompanied by fluctuating profits owing to market volatilities.

Yet, the Vikram Solar IPO GMP has been experiencing fluctuations. As per the latest reports, there has been a slight decrease from ₹69 to ₹60-62 in some of the grey markets, probably due to the overall correction within the markets or because of competing IPOs that are open in the same week. There would be a requirement to constantly check the Vikram Solar IPO GMP because every moment this can vary due to the rates of subscriptions; any global economic news can act as a tipping point.

To understand the Vikram Solar IPO GMP in the right perspective, we can draw a comparison with other recent or upcoming IPOs in the renewable energy sector. For example, after last year’s listing, another solar player, Waaree Energies, recorded a GMP close to 25% which made hefty returns. In fact, only earlier this 2025 did the Premier Energies IPO post such GMP figures of 15-18% that now see proximity to the Vikram Solar IPO GMP.

Vikram Solar bears the highest GMP among the IPOs opening next week, about 19.88%, much higher than Patel Retail at 13.33% and even compared to lower numbers of Shreeji Shipping. That is where investor appetite seems to be stronger brand an established company like Vikram Solar with capacity expansion plans in store. It will utilize the proceeds from the IPO for setting up a new 2 GW manufacturing facility and debt repayment, which would further enhance its growth trajectory.

| IPO Name | Price Band (₹) | GMP (₹) | GMP (%) | Opening Date |

| Vikram Solar | 315-332 | 60-70 | 18-20 | Aug 19, 2025 |

| Patel Retail | 95-100 | 13-15 | 13.33 | Aug 19, 2025 |

| Shreeji Shipping | 78-82 | 10-12 | 12-15 | Aug 19, 2025 |

| Gem Aromatics | 120-130 | 15-18 | 12-14 | Aug 20, 2025 |

As seen in the table, the Vikram Solar IPO GMP leads the pack, making it a prime candidate for those seeking listing pops.

Factors that play into the Vikram Solar IPO GMP. On the positive side, India’s solar market is expected to grow at a 40% CAGR up to 2030 due to policy support and falling module costs. Vikram Solar’s vertical integration-which covers wafer-to-module production-ensures it of a cost advantage that will sustain the high Vikram Solar IPO GMP.

The other risks are the volatility of raw material prices, such as polysilicon, competition from Chinese imports, and regulatory changes. The debt levels of the company, albeit planned to be reduced after the IPO, could be burdensome to the margins. Furthermore, if there is a turn in the overall market sentiment to bearish, just as in the recent global dips, the GMP of Vikram Solar IPO may cool off.

For retail investors, who are the prospective allocation from the Vikram Solar IPO at 35%, this is a blessing. However, oversubscription might lead to the dilution of allotments. On the recommendation of subscribing if one is bullish on renewables by experts but tread with caution with the Vikram Solar IPO GMP as a sole indicator – it’s speculative and does not guarantee anything.

Further, the Vikram Solar IPO GMP brings to light the strategic positioning of the company. Led by Gyanesh Chaudhary, Vikram Solar was earlier a relatively smaller player but now exports its products globally with more than 2 GW installations across the world. Their offering of high-efficiency modules including bifacial and PERC technologies is in line with the global trend towards sustainability in energy.

For FY24, PAT was ₹150 crore (down from ₹200 crores in FY23 on account of one-time expenses) but revenue growth will prove the resilience. The IPO PE at the upper band works out to be around 25x, which is near about peers-if Tata Power Solar or Adani Green were a peer-this justifies buoyant Vikram Solar IPO GMP.

Market analysts are optimistic. According to a report by Equitymaster, Vikram Solar may not only stay ahead of its competitors but in the near future emerge as a distant leader in capacity as well as an export-oriented company. Social media buzz, like threads, and X posts echo this, with Vikram Solar IPO GMP being a recurring buzz.

Investors should have a long-term view. With India targeting 280GW of solar by 2030, companies like Vikram Solar are in for some serious exponential growth. At a Vikram Solar IPO GMP of 19-20%, this would result in listing gains of ₹60-70 per share, meaning quick profits for flippers.

To maximize your chances of getting the allotment in the Vikram Solar IPO, apply on August 19 itself through ASBA or UPI. Keep an eye on the subscription status — if retail oversubscribes by 10x or more, it could be a trigger to push the GMP of the Vikram Solar IPO higher.

On the post-listing watchlist, aspirational catalysts are new contracts, or ramps in capacity. Sector downturns are included as risks but the GMP of Vikram Solar IPO hints at a positive debut.

To sum up, the Vikram Solar IPO Grey Market Premium (GMP) speaks volumes to all prospective investors trying to get a piece of the action in the renewable sector. At ₹60-70, this makes good listing gains with such basics in place. Still, always diversify and take advice. One cannot say that Vikram Solar IPO GMP does wonders, but for those who have faith in solar energy this could be a golden chance.