What Is a Credit Score?

A credit score is a 3-digit number, generally ranging from 300 to 900, that represents your creditworthiness. Credit scores in India are calculated by credit bureaus such as CIBIL (TransUnion) and companies like Experian, Equifax and CRIF High Mark, among others, based on your credit history.

The better your score, the more you are likely to be able to get loans approved quickly and at a lower interest rate. Generally

- 750 is the threshold for excellent

- 700–749 is good

- 650–699 is fair

- Under 650 might be considered poor by most lenders

Why Credit Score Matters in India?

- Loan/Credit Card Approval: Banks and NBFCs use your credit score to evaluate your repayment behaviour.

- Lower Interest Rates: A solid score may allow you to work out better loan terms.

- Larger Credit Limits: Lenders will grant you larger limits if your score is in good standing.

- Quick Approval Process: High scores mean faster approvals with less paperwork.

- Impact on Finding a Job: A few companies do consider the credit report, at least for jobs related to finance.

Maintaining and working to improve your credit score regularly can bring long-term benefits, especially when applying for high-value loans.

Who are the maintainers of credit scores in India?

Four credit bureaus have been licensed in India by the Reserve Bank of India (RBI):

- CIBIL (Credit Information Bureau (India) Limited) is the most popular.

- Equifax – They provide individual credit reports and business credit reports.

- Experian: A global credit information company that has been operating in India since 2010.

- CRIF High Mark – This is familiar to the microfinance and small lenders.

They may all differ slightly in the score assigned to you by each bureau, but the most widely used score in India is the CIBIL score.

How Is Your Credit Score Calculated?

All the bureaus have their own algorithm, although the mentioned points can be outlined as their common essence:

| Factor | Weightage |

| Payment History | ~35% |

| Credit Utilisation Ratio (usage vs. limit) | ~30% |

| Length of Credit History | ~15% |

| Credit Mix (secured & unsecured) | ~10% |

| New Credit Inquiries | ~10% |

As an example, when you default on your EMIs, your score goes down. It is also a red flag to have been consistently using 90% of your credit limit regularly.

How to Check Your Credit Score in India

With the rules set by the RBI credit rules, you are allowed to access your free credit score in India once a year via its official site.

Other websites to find your credit score (and with value-packed services at times):

Look through the authorised channels of the RBI to ensure that there is no misuse of data.

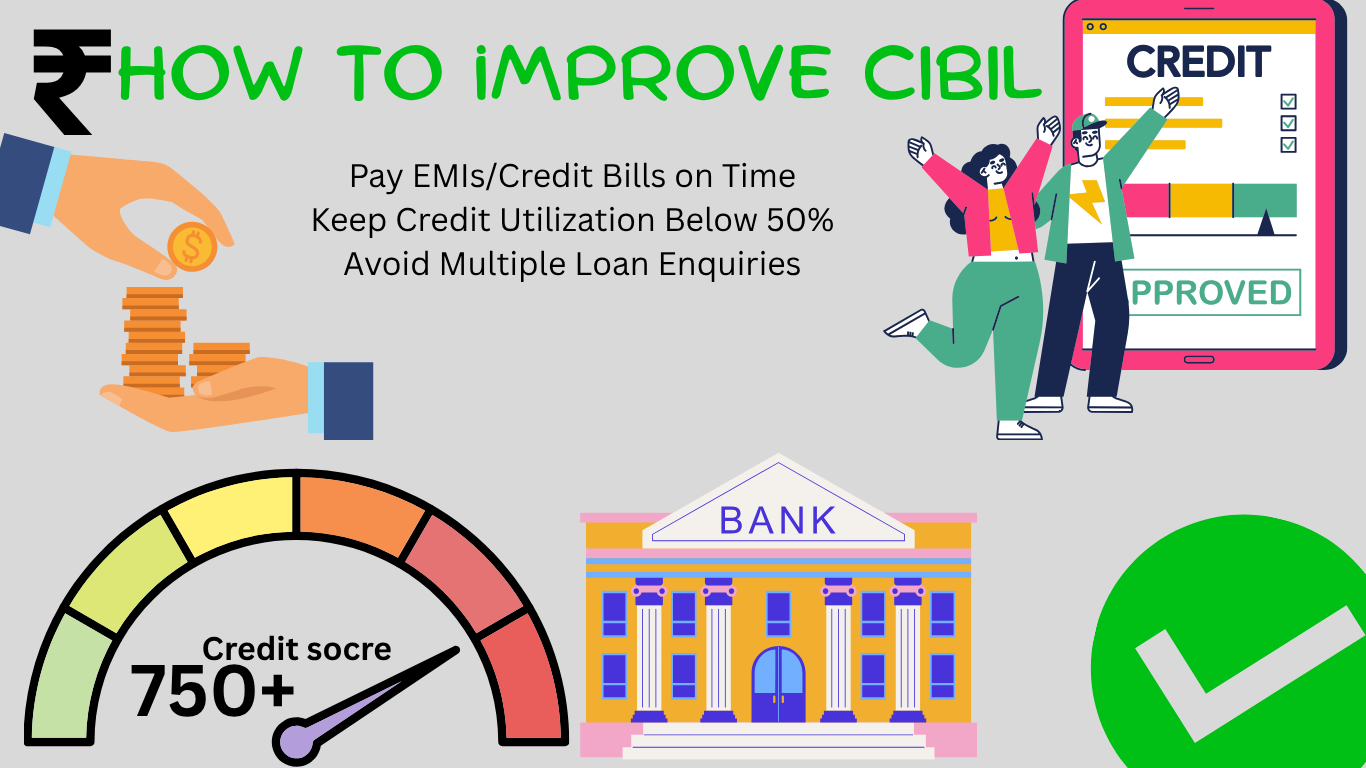

Tips to Improve Your Credit Score

1. Pay all loan EMIs and credit card instalments on time.

2. Make sure you do not use more than 30% of your credit.

3. Avoid applying for and obtaining numerous loans or cards within a very short time duration.

4. Credibility of having a good credit portfolio (secured and unsecured).

5. Monitor the credit report to ensure that there is no error.

6. Do not put yourself in a position to close or get any old credit accounts closed that you do not need.

If you’re wondering how to increase your credit score, start by building a timely repayment habit and maintaining low credit utilisation.

Common Myths Around Credit Score in India

Myth 1: Your score drops when you check your score.

Fact: This is referred to as a soft enquiry, and it bears no effect on your score.

Myth no. 2: The more you earn, the higher your credit score.

Fact: Your credit score has nothing to do with your income. It is about your credit behaviour.

Myth 3: Defaulters are the only ones with low scores.

Fact: Not even the absence of a credit history (zero loans/cards) will leave you with a zero or low score.

Recent Trends and Updates in 2025

- According to the latest 2024 guideline released by the RBI, a lender must notify a borrower of any variation in his or her credit score within 30 days.

- Pricing using credit score is becoming a convention. Other major banks such as HDFC, State Bank of India, and Axis Bank are providing a difference in rate of interest depending on your CIBIL score.

- Start-ups such as Cred and OneScore are aiding customers to follow and enhance their scores by means of gamification and insights into credit scoring.

Conclusion

A credit score in India is not just a number but can be called a financial passport. Whether it is loan approvals, more favourable interest rates, or even employment opportunities, your score influences critical aspects of your finances. First, find out your score, know your position and do something to increase or establish it. It cannot be done in a single night, and neither can you get a good credit rating by being undisciplined and making wrong decisions.