A loan against an insurance policy is a financial product through which the policyholder gets money on account of pledging his life insurance policy. Rather than surrender value or high-interest personal loans, quick funds are made available while the cover continues, and all benefits under the insurance coverage are intact.

A loan against a life insurance policy is preferred because it has low interest rates to be compared with unsecured personal loans. It gets approved faster with minimal paperwork, thus an attractive option at the time of fulfilling urgent needs like medical, educational, or business requirements without breaking long-term investments.

Monetary organizations, including famous suppliers like Bajaj Finance advance against insurance strategies and Bajaj Finserv advance against insurance approaches, offer this office to policyholders who have fabricated a satisfactory surrender esteem in their arrangements. By picking this course, borrowers can get to transient liquidity while keeping their protection unblemished.

What is a Loan Against Insurance Policy?

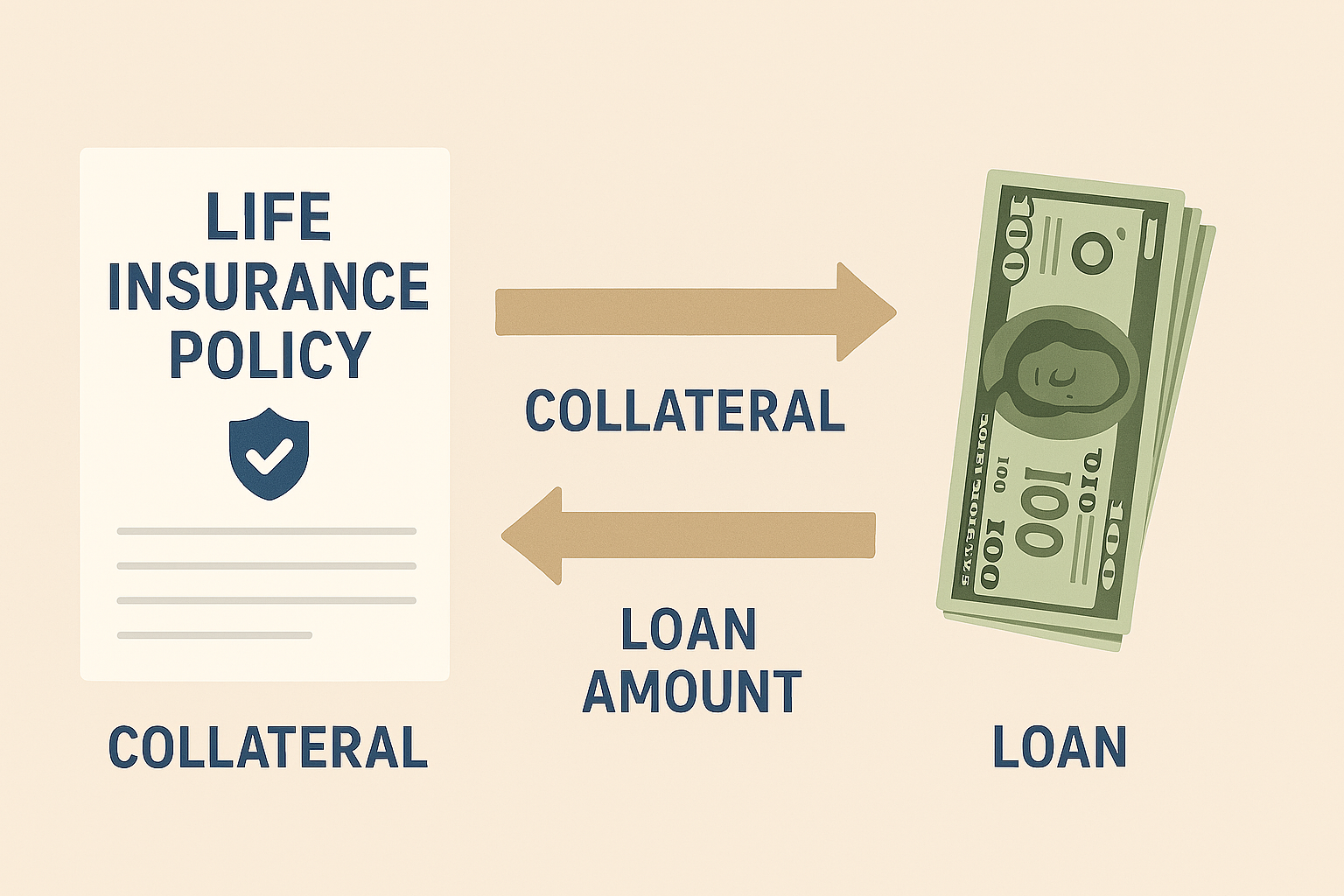

A loan against insurance policy is a secured advance that permits you to acquire assets by swearing your life coverage strategy to the moneylender. Rather than giving up your strategy, you can open its developed acquiescence worth and use it as security to address monetary issues; along these lines, protection inclusion stays in force while getting reserves.

It is only available on those plans that build up some cash value, for example, endowment or whole life policies. Pure protection covers such as term insurance do not qualify since they don’t accumulate any surrender value.

When one takes a loan against a life insurance policy, the amount that is borrowed is in most cases a percentage of the surrender value of the policy— in many cases between 80% and 90%. Thus, it becomes an easy source for funds at times of requirements.

Financial providers like Bajaj Finance loan against insurance policies and Bajaj Finserv loan against insurance policies have made this option immensely accessible with competitive interest rates and simple application processes.

Key Features of a Loan Against Insurance Policy

A loan against insurance policy comes with several unique features that make it different from other types of loans. Here are the most important ones:

- Loan Amount Based on Policy Value

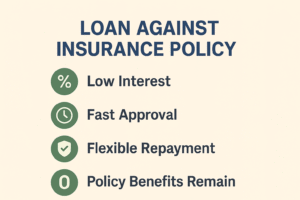

The amount you can borrow depends on your policy’s surrender value. In most cases, lenders allow up to 80–90% of the surrender value as a loan. - Lower Interest Rates

Since this loan is secured, the rate of interest can regularly be lower than an ‘unsecured’ personal loan or that assessed to outstanding balances on a credit card.’ Opting for a loan on my life insurance policy might save you quite a sum of that interest payment. - Quick Disbursal and Minimal Documentation

The process is simple. You only need your policy documents and basic KYC details. Many providers, including Bajaj Finance loan against insurance policy and Bajaj Finserv loan against insurance policy, ensure fast approval and quick disbursal. - Flexible Re-payment

Loan repayment can be in installments or in a lump sum, depending on the terms of the lender. Some policies even go further to allow one to continue paying only the interest and then clear the principal later. - Policy Benefits Remain Intact

As long as repayments are made on time, your life insurance coverage continues, and you don’t lose the protection benefits for your family.

Benefits of Taking a Loan Against Insurance Policy

Opting for a loan against insurance policy offers several practical advantages compared to other borrowing options. Here are the key benefits:

- Access to Quick Funds

Emergencies don’t wait. Neither should you. A loan on a life insurance policy can quickly grant you access to money without the extended process of approval tied to unsecured loans. - Affordable Borrowing

Since your policy acts as collateral, lenders offer lower interest rates. Providers like Bajaj Finance loan against insurance policy and Bajaj Finserv loan against insurance policy are known for competitive rates, making repayment easier on your budget. - Minimal Documentation

You don’t need to submit piles of papers. Usually, your insurance policy document along with basic ID and address proof are enough. - No Need to Surrender the Policy

One of the biggest advantages is that you don’t have to give up your insurance. Your coverage remains active while you use its value to borrow money. - Flexible Re-payment Options

Choosing repayment terms according to your financial situation from paying monthly EMIs or settling the principal later is something that lenders allow.

Risks and Limitations of a Loan Against Insurance Policy

While a loan against insurance policy has many advantages, it also comes with certain risks and restrictions you should be aware of before applying.

- Risk of Policy Lapse

Should you not pay back the loan or interest in due time, the insurer can take away the unpaid sum from your policy’s surrender worth. In severe situations, your policy might end leaving you with no insurance cover. - Limited Loan Amount

The loan amount is tied to the surrender value of your policy. This means if your policy is still new and has built up little value, the borrowing limit may not be sufficient. For instance, even under a loan against life insurance policy, you can only borrow a percentage of the surrender value, not the full policy amount. - Not Available for All Policies

Pure term plans are not eligible because they don’t accumulate a surrender value. Only traditional plans like endowment or whole life policies qualify. - Interest Accumulation

It’s true that repayments are flexible, but unpaid interest piles up fast. companies such as Bajaj Finance Against Policy or Bajaj Finserv loan against insurance policy offer very competitive rates but still, the discipline in repayment is a must. - Impact on Maturity Benefits

The loan amount together with interest will be deducted from the maturity or death benefit of the policy, hence reducing the financial support that accrues to your family later on.

Eligibility & Documentation Required

Applying for a loan against insurance policy is usually straightforward, but there are certain eligibility rules and documents you’ll need to prepare.

Eligibility Criteria

- Policyholder Requirement – Only the policyholder can apply for the loan.

- Type of Policy – A loan against life insurance policy is generally available only for traditional plans such as endowment or whole life insurance, since these build a surrender value.

- Surrender Value – The policy must have a minimum surrender value for the loan to be approved.

- Active Policy Status – The insurance policy should be active and premiums must be paid up to date.

Documents Required

Most lenders, including Bajaj Finance loan against insurance policy and Bajaj Finserv loan against insurance policy, require only minimal paperwork. Typically, you’ll need:

- Original insurance policy document

- Identity proof (Aadhar card, PAN card, or passport)

- Address proof (utility bill, driving license, etc.)

- Loan application form provided by the lender

By keeping the requirements simple, financial institutions make it easier for policyholders to get quick access to funds without unnecessary hurdles.

Loan Against Insurance Policy vs Personal Loan

When you need urgent money, both a personal loan and a loan against insurance policy can seem like viable options. However, they work very differently. Here’s a comparison to help you decide:

- Collateral Requirement

- Loan Against Insurance Policy – You have to pledge your life insurance policy as collateral.

- Personal Loan – Since the loan is unsecured, no collateral is required.

- Interest Rates

- Normally, a loan against a life insurance policy will attract lower interest rates since it is secured by the surrender value of the policy.

- Personal loans being unsecured normally attract higher interest rates.

- Loan Amount

- With a loan against insurance policy, the amount you can borrow depends on the policy’s surrender value (generally 80–90%).

- Personal loans depend on your income, credit score, and repayment capacity.

- Approval and Processing Time

- Providers like Bajaj Finance loan against insurance policy and Bajaj Finserv loan against insurance policy often approve and disburse loans quickly, since documentation is minimal.

- Personal loans may take longer due to credit checks and detailed income verification.

- Impact on Insurance Coverage

- With a loan against insurance policy, your insurance cover remains active as long as repayments are made.

- A personal loan has no connection to your insurance policy.

Verdict:

If you own a life insurance policy with a good surrender value, borrowing against it is among the cheap and easy ways to liquidate an asset. This would imply that personal loans are most appropriate in the absence of qualification for a policy or for when one needs an elevated loan amount.

Steps to Apply for a Loan Against Insurance Policy

The process involved in obtaining an insurance policy loan is generally very quick and trouble-free if the prescribed steps are followed. Here’s how:

Step 1: Check If Policy Is Eligible

Check whether or not your insurance policy is qualifying for a loan. Loan facilities can be extended against only such types of policies that carry some surrender value like endowment or whole life assurance schemes and not term insurance plans.

Step 2: Apply to the Registered Lender

You may either contact your insurer or financial institutions like Bajaj Finance loan against insurance policy or Bajaj Finserv loan against insurance policy which are specialized in providing this facility.

Step 3: Submit Required Documents

Submit the policy papers together with KYC documents that include ID and address proof. Since documentation is minimal, it gets approved faster than most other loans.

Step 4: Loan Evaluation

The lender will assess the surrender value of your policy and let you know how much loan you can get, generally up to 80–90% of that value.

Step 5: Approval and Disbursal

Once approval is received, the loan goes straight into your bank account. In most cases, it gets completed within a few working days.

Things to Keep in Mind Before Applying

While a loan against insurance policy can be very useful, it’s important to consider a few key points before applying:

- Repayment Discipline

Even though the process is simple, failing to repay the loan or interest on time can reduce your policy’s surrender value or even cause the policy to lapse. - Impact on Maturity or Death Benefits

Any outstanding loan amount, along with accrued interest, will be deducted from the maturity payout or death benefit. This can affect the financial support your family receives. - Loan Amount Limitations

The amount you can borrow depends on your policy’s surrender value. Ensure it meets your financial requirement before applying for a loan against life insurance policy. - Interest Rates and Charges

Even though rates are lower than personal loans, unpaid interest can accumulate. Check with lenders such as Bajaj Finance loan against insurance policy or Bajaj Finserv loan against insurance policy about interest terms and any processing fees. - Alternative Options

Evaluate if other financing options might better suit your needs. Sometimes a personal loan or other secured loan could be more appropriate depending on the situation.

By keeping these points in mind, you can make an informed decision and take full advantage of a loan against insurance policy without any surprises.

Conclusion

Pawnbrokering of the insurance cover would generally refer to the smart approach of availing quick cash against the promise without surrendering the life cover. That’s low-interest charging, minimum documentation, and flexible in repayment then safer than most personal loans conditions.

Whether it’s life policy loan with the insurance company you are dealing with or a financial company like Bajaj Finance loan on insurance policy or Bajaj Finserv loan against insurance policy, you can keep hold of your long-term coverage and access the required funds.Consider eligibility. Consider repayment discipline. Consider the effect on maturity benefits. Then make the most out of this borrowing option while ensuring your insurance goals are safeguarded.